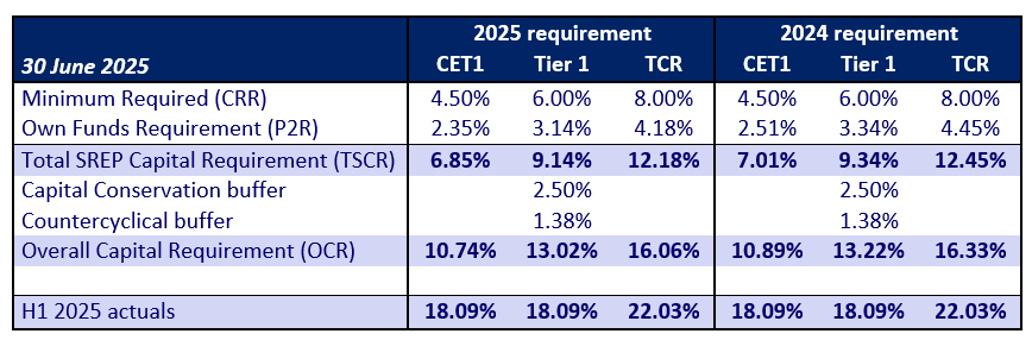

DNB has set quantitative prudential requirements as part of the SREP 2025 decision for Triodos Bank. The Total SREP Capital Requirement (TSCR) for Triodos Bank on a consolidated basis is 12.18%. Consisting of a Pillar 1 Capital Requirement of 8.00% and a Pillar 2 Capital Requirement of 4.18%, a slight decrease from the requirement for 2024 (4.45%).

The Overall Capital Requirement (OCR) for Tier 1 Capital for Triodos Bank on a consolidated basis is 13.02%, including a Capital Conservation Buffer (CCoB) of 2.50%, and the Countercyclical Capital Buffer (CCyB) of 1.38% as per 30 June 2025.

On 30 June 2025, Triodos Bank reported its 2025 half year results, including a Common Equity Tier 1 (CET1) ratio of 18.09%, comfortably above its medium-term target of more than 15.0% and meeting both the 2024 and 2025 SREP requirements. The Bank also reported a consolidated Total Capital Ratio (TCR) of 22.03%.

Disclaimer

The information in this document has been obtained or derived from sources believed by Triodos Bank N.V. to be reliable at the date of publication of this document. However, no representations are made as to its accuracy or completeness. The information may be subject to change, and Triodos Bank N.V. assumes no undertaking to revise or amend the information provided, or to provide any update in respect of any change related thereto. Triodos Bank N.V. accepts no liability for loss arising from the use of the information. The information is: (i) for discussion purposes only; (ii) not to be regarded as (investment) advice; and (iii) not to be relied upon in substitution for the exercise of independent and sound judgement.

This document does not constitute any commitment or any offer to commit to any transaction or financing by Triodos Bank N.V.

This document may include forward-looking statements. All statements other than statements of historical facts may be forward-looking statements. Some of these forward-looking statements are characterised by the use of words such as (but not limited to): 'expect', 'anticipate', 'estimate', 'may', 'should', 'would', 'believe', 'intend', 'plan', 'contemplate', 'aim', 'could', 'will', 'potential', 'think', 'seek', as well as similar expressions, the future tense and the conditional. The forward-looking statements included in this document with respect to the business, results of operation and financial condition of Triodos Bank N.V. are subject to a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements, including but not limited to the following: changes in economic and political conditions, actions taken and policies applied by governments and their agencies, changes in credit spreads or interest rates, the results of our strategy and investment policies and objectives. Triodos Bank N.V. undertakes no obligation to update or revise any forward-looking statement to reflect events or circumstances that may arise after the date of this document.