Humanity now risks triggering tipping points, of which some can be reached already at 1.5°C temperature rise. For example, the west-Antarctic ice sheet melt is likely unavoidable. Altogether, current government plans are insufficient, companies lack ambition and real change is not happening fast enough. The world is currently heading for a 2.5 - 2.9°C temperature rise scenario.

The outcome of COP28 to the United Nations Framework Convention on Climate Change also felt short on turning the tide as there was no firm agreement on phasing out the use of fossil fuels. This means the role of, citizens, financial institutions and other businesses is increasingly important.

AsOneToZero

Decisive climate action is needed to reduce global greenhouse gas emissions (GHG). Triodos Bank stands behind the Paris Agreement target on limiting global temperature rise to 1.5 °C degrees above pre-industrial levels and supports the sustainable and inclusive transition of our economies and society.

The main cause of the global climate crisis is the burning of fossil fuels. Therefore, it is essential that the production and use of fossil fuels is phased out. Triodos Bank does not finance fossil fuel industries. This makes our current carbon footprint relatively low compared to the average in the financial sector.

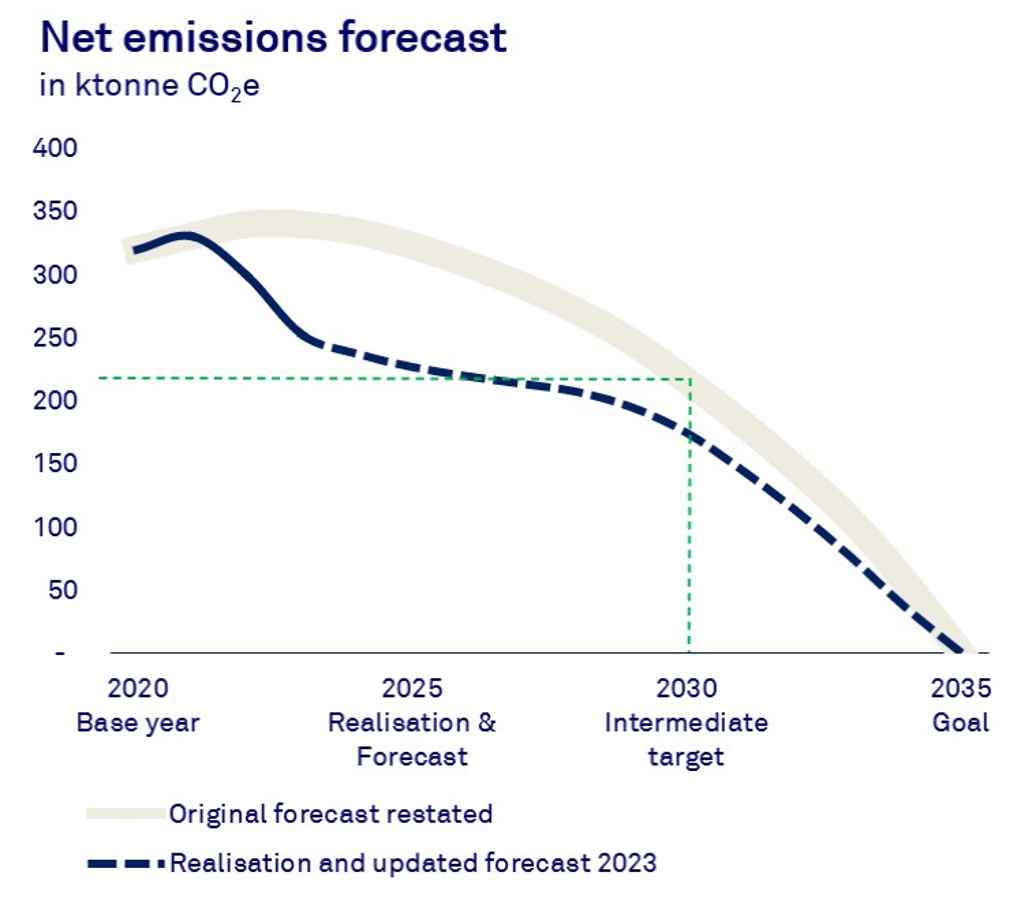

However, Triodos Bank is striving for a fossil free economy. This means we need to work closely together with our clients, investees, coworkers and other stakeholders to reduce emissions. Our ambition is that the sum of all greenhouse gas emissions and emission removals of Triodos Bank's operations, loans and investments will reach net-zero by 2035. The remaining gross emissions will be balanced by investing in nature-based solutions that protect and strengthen natural carbon sinks and remove GHG from the atmosphere. This 'AsOneToZero' target was communicated before COP26 in November 2021.

What sets us apart in our net zero approach is that we take all our financed emissions into account. Just focussing on own operations or a part of the portfolio is simply not enough. We believe that taking all activities and sectors in account is essential for the transition to a net-zero society, we can only get there if we act as one.

13/03/25 - While we're ahead in cutting real emissions, new insights and stricter standards mean we can no longer claim to be aiming to achieve net-zero by 2035. We will update our climate strategy accordingly in 2025. Please have a look at: https://www.triodos.com/en/climate-strategy.

Decreasing emissions

Despite our growing portfolio of loans and investments, we were able to report a 12% decrease to 271 kilotonnes gross GHG emissions in 2023. This decrease is mostly caused by the fast decarbonisation of the overall electricity market, which means that the power supplied to customers and investees is becoming increasingly greener.

Most importantly however, we start to see the actions of our community of customers and other stakeholder to reduce their CO2 footprint contribute to this positive downward trend.Ultimately, we will have to succeed together with our customers and investees to reduce GHG emissions. We will continue to engage with them, helping them to realise a reduction in emissions. During 2023, we engaged with 172 top-emitting business banking customers and agreed on follow-up plans with 86 of them. The insights will be used in 2024 to improve our engagement on emission reduction with our customers.

Financing nature

We also finance forestry and nature development projects to remove carbon from the atmosphere. This is called sequestration. Our share in these projects resulted in the sequestration of approximately 19 kilotonnes CO2 (2022: 10 kt CO2), equal to at least 714,000 mature trees. The increase is mainly due to financing new projects, such as Oxygen Conservation in Scotland or Bosque de Matasnos in Spain.

Renewable energy projects

Our share in the 640 renewable energy and energy saving projects that we finance avoided over 996 kilotonnes of CO2e emissions as compared to fossil fuel power generation (2022: 1,048 kt CO2e). This is equal to the avoidance of emissions of approximately 6.8 billion kilometres travelled by 570,000 cars.

Financial sector should embrace non-proliferation treaty

We believe financial institutions will need to plot a similar path if we are to play our part as an industry in keeping the global increase in temperature within acceptable bounds. That is why we were the first bank to join the global campaign for a Fossil Fuel Non-Proliferation Treaty, meant to help phase out the use of coal, oil and gas.

The Fossil Fuel Non-Proliferation Treaty initiative is a global effort to meet the goals of the Paris Agreement by fostering international cooperation to accelerate a transition to clean energy for everyone, end the expansion of coal, oil and gas, and phase out existing production. This needs to be done in a manner that is both fast and fair, so that no person, community or country is left behind and in keeping with what science shows is needed to address the climate crisis.

If the financial sector is serious about its sustainable commitments, it should support the treaty initiative. A treaty will help create a steady business climate with long term perspective and a level playing field, which is in the interest of every business and financial institution.