‘I recently spoke with a sustainability expert from one of the world's largest asset managers. He wanted to exchange ideas after a critical column about his employer. It was an open conversation in which we largely agreed on the need for a rapid transition to a sustainable economic system. But we didn’t agree about the role that asset managers themselves (should) play in this.

Behind the scenes, asset managers and consultancy firms set the course

According to the sustainability expert, the ball is mainly in the court of governments and the ultimate investors (asset owners). Yes, American giants such as BlackRock, Vanguard and State Street are the largest shareholders in almost 90% of the companies in the S&P 500 and in for instance more than half of the companies listed on the Dutch AEX. But he argues it is still the customer who decides where the money goes. Asset managers can merely offer sufficient sustainable investment opportunities.

But that is way too simplistic, because the lion's share of clients delegate their shareholder power to the asset manager, or do not have access to voting rights at all. As a result, the internal guidelines of asset managers are decisive at shareholder meetings where the strategic course of companies is determined. And these guidelines are mainly aimed at slowing down the sustainability transition, because social or ecological proposals rarely receive support.

This invisible power is not only concentrated amongst asset managers. The large consultancy firms also pull the strings in our economy and are certainly not the objective brokers of expertise they claim to be. Economists Mariana Mazzucato and Rosie Collington convincingly demonstrate how these firms, through advice and delegated management functions, profoundly influence the course of companies and governments. They, too, deliberately slow down the sustainability transition, because their revenue model still relies heavily on polluting sectors.

The top brass has no ideals

Nevertheless, the ideals of the sustainability expert I spoke with seem sincere. And he is not alone: in 2021, in a rare leaked expression of discontent, more than a thousand McKinsey consultants called on their employer to provide insight into their clients' CO₂ emissions. ‘Our positive impact in other areas will mean nothing if we do not prevent our clients from irreversibly changing the earth,’ they wrote. A courageous appeal, but one without follow-up.

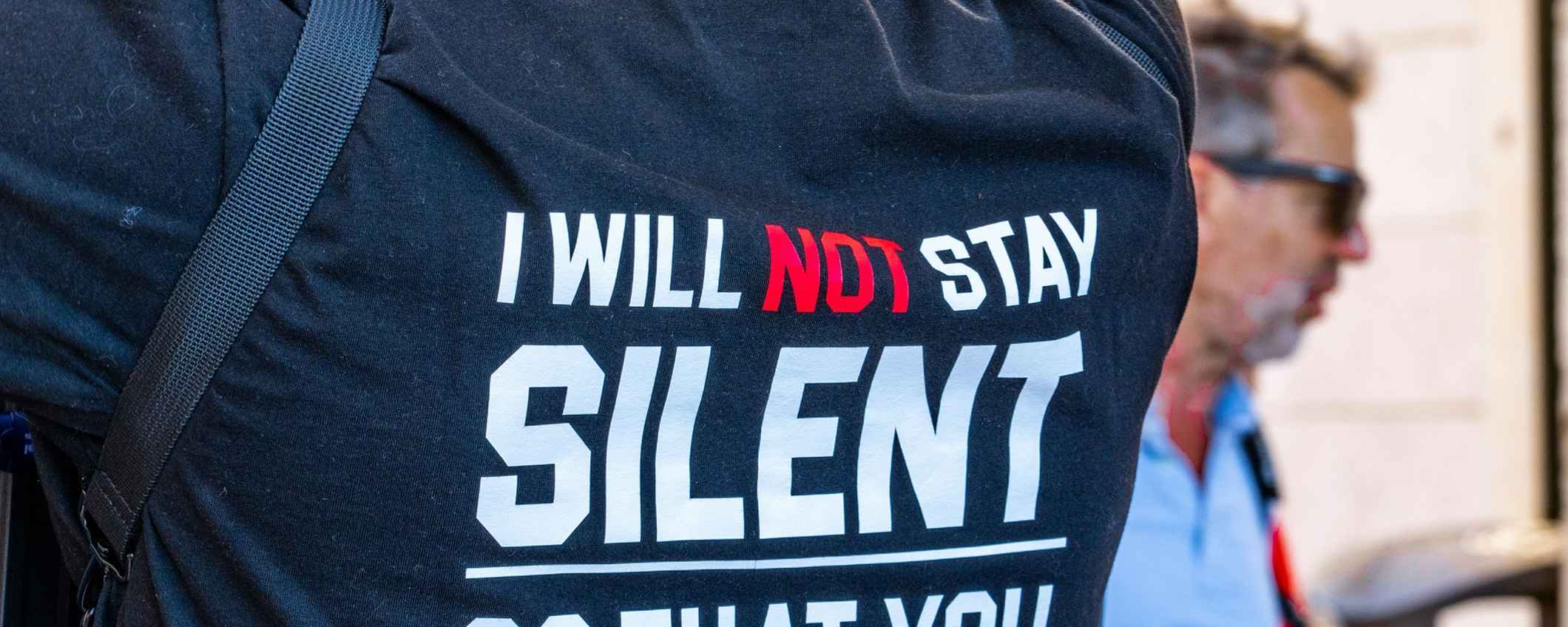

Moreover, since then, a harsh anti-ESG wind has been blowing from the US, pushing the top of asset management and consultancy firms further into the wrong direction. Inevitable, according to my discussion partner, given the legal risks. However, after their earlier grand statements about sustainability, one would at least expect top executives to publicly voice their opposition. But the silence is telling.

Sustainability experts, make yourselves be heard

That is precisely why it is now time for sustainability experts to make themselves be heard. They often justify their choice to work for such companies with the argument that the best way to change the system is from within. But that promise is empty if nothing changes. Then their role does not extend beyond greenwashing the company's activities, and they would be better off leaving.

Of course, it is not easy to be a thorn in the side of hierarchical, conservative organisations. But that is the essence of moral courage: acting when it is not convenient. Moreover, these experts are usually not the naive twenty-somethings who, straight out of university, disappear into the comfortable “Bermuda triangle of talent”. This are sustainability professionals with (some) experience who consciously switched to the dark side. We can expect more from them.

So embrace activism, by not hiding internally and speak up during meetings, and externally by defying the views of your employer. Society is entitled to louder, more assertive sustainability experts.'

This opinion piece was previously published in Dutch in Financial Investigator